Our portfolio is a diversified mix of assets across different asset classes and geographies.

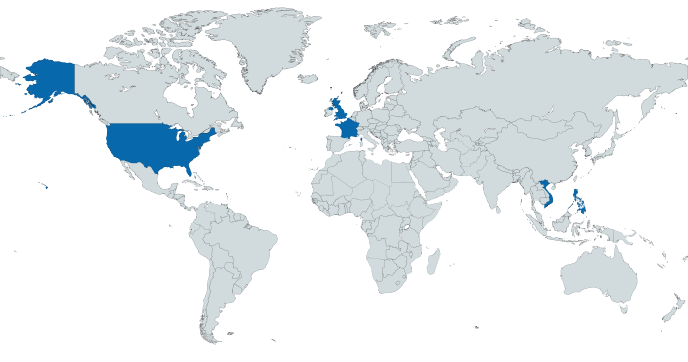

In stocks, we hold positions in companies in Vietnam and the Philippines that we believe are undervalued by the market but have strong potential for future growth. These stocks are held with a long-term investment horizon, and we conduct regular research and due diligence to monitor our investments and identify new opportunities.

Regarding the bond market, we hold corporate bonds with high yields that we believe exhibit relatively low credit risk. We conduct comprehensive credit analysis and due diligence to identify bonds issued by financially stable and well-established companies with a history of meeting their debt obligations.

In real estate, we hold properties in three different countries: the United States (Texas), the United Kingdom (London), and France. Our properties in Houston offer substantial long-term appreciation potential, while those in Europe ensure effective portfolio diversification and contribute to solid income generation through rental returns. Before investing, we conduct extensive due diligence on each property, and we actively manage them to ensure they are well-maintained and generate strong returns.

Moreover, we invest in Southeast Asian startups that have been identified as high-growth opportunities with significant return potential. We take a proactive approach to developing these startups by providing them with the necessary resources, support, and guidance they need to grow and succeed.

Overall, our portfolio is designed to achieve our investment goals while mitigating risk through diversification across different asset classes and geographies. We follow a disciplined value investing strategy, seeking out undervalued assets with strong potential for future growth. We are committed to monitoring and adjusting our portfolio regularly to ensure it continues to meet our investment objectives.